Powerful thinking.

Empowering leaders in understanding the evolving trends and challenges that influence their growth strategies.

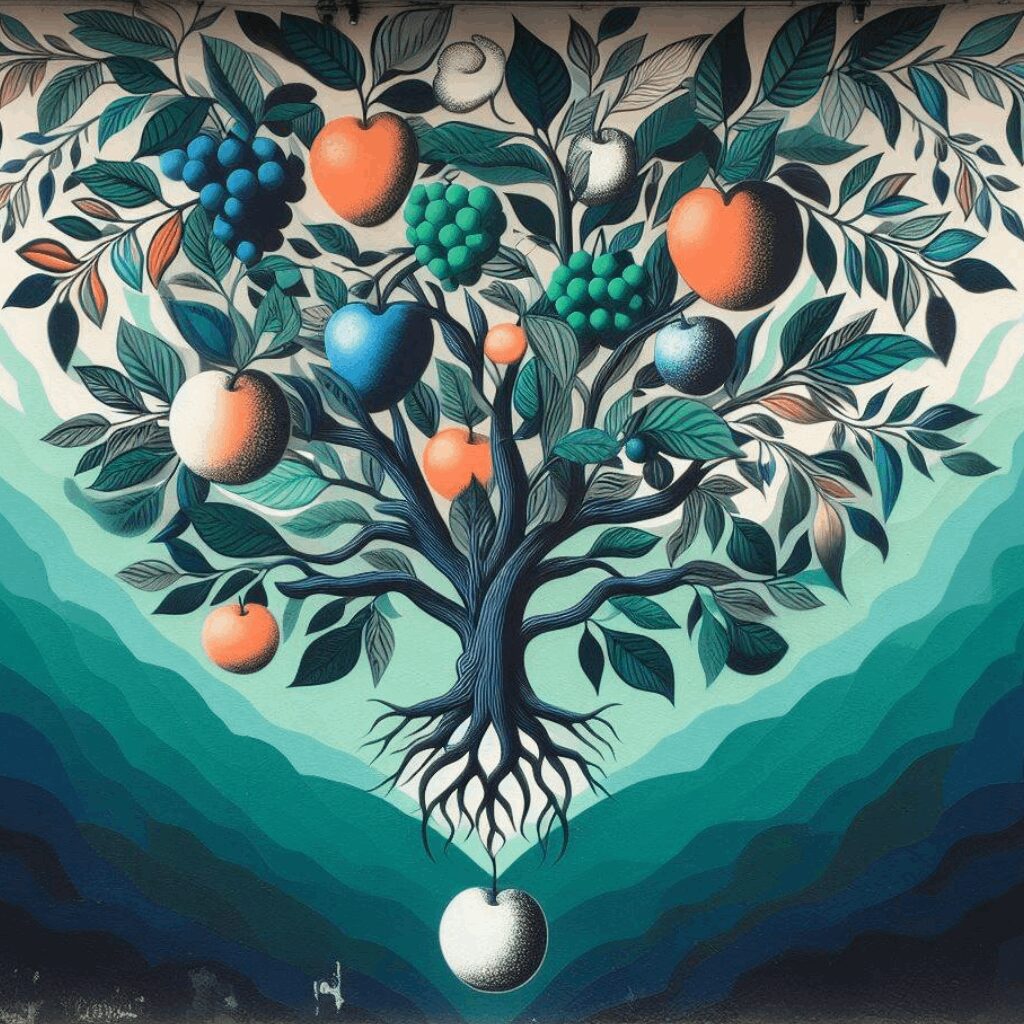

From low-hanging fruit to high-impact strategies: the future of value creation in Private Equity

In our latest paper, "From low-hanging fruit to high-impact strategies: The future of value creation in Private Equity," we discuss why relying mostly on financial engineering is no longer a viable strategy to build value in Private Equity.

By Michelle Sartorio | Founder and CEO | True Value Creation

- June 27, 2024

Get in touch with us to explore how forward-thinking wealth management leaders can adjust their visions and strategies to future-proof their businesses.

What lies ahead for value creation in Private Equity?

What lies ahead for value creation in Private Equity?

Private Equity has experienced a roller-coaster journey from the early 2000s to 2024, encompassing periods of volatility, prosperity, and transformation. In recent years, rising inflation and borrowing costs have created a challenging environment for private capital, prompting a shift away from traditional value creation methods in response to this evolving landscape.

The paper offers a forward-thinking perspective on the transformative journey of value creation in PE, as it argues that a focus only on ‘low-hanging fruits’ is no longer a viable strategy to sustain value; we advocate for a holistic, comprehensive approach encompassing revenue growth, margin enhancement, operational excellence, innovation, and the integration of sustainability considerations.

Whether you’re an investor, private company, or PE professional, this paper equips you with insights to navigate the evolving PE landscape.

Download the paper now >>

Get in touch with us to explore how forward-thinking leaders can adjust their visions and growth strategies to future-proof their businesses.

- All Posts

- Blog

- Back

- Go-to-market and branding

- Strategic communications

- Sustainability and impact